Turning the vicious cycle into a virtuous one

Sep 27th 2018

IN 2001, WHILE studying economics at the University of California, Los Angeles, Dan Kurzrock got into beermaking. He soon discovered that for every five-gallon (19-litre) batch of ale, the brewing process yielded up to 22lbs (10kg) of mulch-like spent grains. “It felt like making food,” he recalls. And it didn’t taste all bad, either—after all, it was wholesome fibres and protein left over from a process which extracts sugars from cereals for fermentation. If he was producing kilograms of it, how much goodness was going to waste at breweries?

The answer was a lot. A rough calculation based on the volume of beer brewed in America puts the total spent grain at 1.4m tonnes a year. Large brewers often let local farmers pick up the by-products for livestock feed. But at craft breweries sprouting in cities all over the world, these would often head straight for the landfill. “It would be a commodity if there were a market,” Mr Kurzrock remembers thinking. So he set out to create one.

In 2012 he and Jordan Schwartz, a college chum, founded ReGrained to commercialise a recipe they developed to turn spent grain, collected free from local craft brewers in San Francisco, into energy bars. In September they inaugurated a new factory near the city to cook up the main ingredient and sell to food producers. Griffith Foods, a big producer of doughs and condiments, has invested in the company. Barilla, an Italian firm, is working with ReGrained on a line of beer-derived pasta.

Recycling—for that is what ReGrained does—is nothing new. The word (at least its English version) dates back to the 1920s but the activity is as old as mankind. As the variety of materials churned out by the modern economy has increased, however, so have attempts to repurpose ever more of them.

In 2009-15 the number of biogas plants in the EU grew from 6,000 to 17,700—heating houses with old banana skins and uneaten porridge

Fans of the “circular economy” relish epiphanies such as that which led Messrs Kurzrock and Schwartz to their idea. They lower the economy’s environmental footprint twice over: reducing the amount both of natural resources (cereals to make a snack) and of refuse. They take something people would pay someone to take off their hands—waste—and convert it into something people are willing to purchase—a resource.

The trick is performing such alchemy profitably and at scale. It is already happening. In most rich countries a third of glass and two-thirds of paper come from recovered materials. Around half of aluminium sold in North America each year is derived from scrap. Each day the United States alone churns out 25 Eiffel towers’ worth of steel and other ferrous scrap. Recycled copper satisfies two-fifths of global demand for the metal. There are reasons to believe that market forces will drive similar developments for other materials. Electronic and electrical devices look particularly ripe for harvesting. But plastics are the biggest problem, with only 10% currently recycled.

Diamonds on the soles of their shoes

Nearly everything can be recycled, says Tom Szaky of Terracycle. It is not just things like plastic bags or textiles, which a recent survey found one in two Britons incorrectly assumes to be unrecyclable. Mr Szaky’s firm has devised a way to turn cigarette filters, made of a polymer called cellulose acetate, into sturdy plastic boarding. Plastic polymers can be chemically unwound into their original hydrocarbons. In April a Dutch company started selling training shoes with soles made from chewing gum scraped off the streets of Amsterdam.

Some people will pay a premium for products that salve their conscience. The environmental appeal is an inherent part of the brand. For most customers “environmental considerations continue to be ‘nice to have’,” says Gavin McIntyre of Ecovative Design, which uses fungi to turn agricultural waste into high-grade composite materials. Crucially, they are not yet ‘must have’. The central concern is price.

Recycled materials compete with virgin ones, so recyclers are hostage to volatile raw-material prices. Recyclers’ costs depend on the cost of collection, distribution and processing of scrap, which tend to be stable. Commodity prices—which determine the price for recyclers’ output—can swing wildly. When prices of primary resources drop suddenly, recovered materials are no longer competitive. This can drive recyclers out of business. The uncertainty discourages long-term investments, keeping most recycling firms small and inefficient. That in turn constrains the supply of recycled materials. Big manufacturers want a steady supply of materials, which recyclers therefore find it hard to guarantee.

Things such as glass, paper and many metals have broken out of this vicious circle, typically once economies spewed out enough of them to make it worthwhile to recycle. Reprocessing technology had often been around for a while—paper was being recycled in the 19th century—but greater availability of source materials encouraged efficiencies. That in turn spurred demand for these materials and itself encouraged further improvements in recovery. In other words, a vicious cycle turned virtuous.

In some areas, a similar virtuous turn looks not just possible but imminent. Last year scholars at United Nations University in Tokyo calculated that the 45m tonnes of defunct fridges, radios, smartphones and the like discarded annually worldwide contain $55bn-worth of gold, silver and other valuables. According to research from Tsinghua University in China and Macquarie University in Australia, it costs Chinese recyclers of defunct electronic devices (known as “e-waste”) $2,000 to extract a kilogram of gold from old television sets; mined from the ground, the metal fetches $40,000 a kilo. The recyclers outperform miners even after stripping out the $13 that the Chinese government subsidises them per television. Facts like these help explain how the American e-recycling business went from less than $1bn in 2002 to more than $20bn in 2016, and why today’s 20% recycling rate for e-waste looks poised to rise.

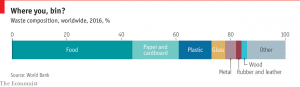

Not all materials are as precious as gold and silver. But progress is visible even in areas such as food waste, the world’s most common form (see chart) and construction debris. “Anaerobic digestion”, in which organic matter is broken by microbes in the absence of oxygen, produces biogas which can be burned for energy or heat. In 2009-16 the number of biogas plants in Europe grew from 6,000 to 17,700—heating houses with old banana skins and uneaten porridge. It still produces only 2% of EU electricity but the share looks set to grow as more governments tackle food waste and encourage renewable energy. Meanwhile, Ecovative is an example of a company that turns food waste into durable goods, such as high-grade faux leather. ZEN Robotics of Finland sells smart disassembly lines for construction rubble where computer-vision algorithms identify pieces of metal, cardboard or other valuables for a robotic arm to pluck from the conveyor belt. Companies like Jiangsu LVHE in Changzhou, outside Shanghai, use the system to recover materials for reuse or resale, and bake the remaining debris into bricks, tiles and other building wares.

The problem for plastics is that hundreds of everyday polymers are incredibly cheap to make from petroleum, and comparatively costly to extract from the waste stream compared with less heterogeneous materials like paper, glass or even metals. This has kept plastics stuck in the negative feedback loop of low demand, low investment and low supply. The market will only develop if there is an increase in demand, thinks Jean-Marc Boursier, vice-president of Suez, a giant French waste-management and recycling company.

The Chinese ban may in time provide just such a jolt, by forcing countries used to dispatching their recovered plastics abroad—as Ireland has done with 95% of its total—to reprocess more at home. But even before the prohibition entered into force at the start of the year, rising public angst over plastic pollution had begun to concentrate policymakers’ minds on how to make reused plastic more attractive relative to the virgin kind.

Fiscal incentives are one way. For instance, exempting second-hand polymers from value-added tax is defended on the grounds that the primary material has already been taxed. As well as being desirable to combat climate change, carbon taxes favour less energy-intensive recycled plastic production. More hands-on proposals are also being aired. The EU’s new recycling targets are one example, especially now that poorly recycled plastic can no longer be palmed off on China. Campaigners are also pressing the EU to mandate a minimum recycled content in plastic containers, as California has had since 1991.

“Extended producer responsibility” (EPR) has become a particular favourite among campaigners and policymakers alike. EPR rules make manufacturers and brands contribute to the net cost of their products’ disposal once consumers are done with them. This cost is lower if the products can be sold to recyclers. The number of such policies rose from a few dozen in the early 1990s to nearly 400 worldwide by 2013, according to the OECD. Nearly all of the club’s 34 mostly rich members now have them for different types of product, as does Taiwan. Latin American countries like Brazil, Colombia and Chile have them, too. South-East Asian countries are working on them. Last year China unveiled a plan to draft comprehensive EPR legislation by 2025. Such policies may in time bring the plastics recycling rate from 10-20% today closer to the 60-80% rate currently enjoyed by other materials such as aluminium, steel and paper.

All of this should help boost recycling. But some firms have ambitions to embrace the other two components of the circular-economy triad, by reusing products rather than materials, and even reducing production altogether. Companies like the Renewal Workshop are putting a new spin on second-hand clothing. They take old garments and refashion them into new items, with the approval of the original brands (for the Renewal Workshop these include North Face). Darrel Stickler, Cisco’s head of sustainability, discerns a promising second-hand market for the company’s networking gear, $3bn-worth of which is bought and sold each year. Cisco’s share of this is tiny but could be much bigger, Mr Stickler thinks.

Meanwhile, some big manufacturers are reorienting from making products to selling services. Martin Stuchtey of SystemIQ, a consultancy, says that nine out of ten boardrooms he visits are debating “how to sell freshness, not fridges; kilometres, not tyres”. Rolls-Royce has sold “power by the hour” rather than aircraft engines for years. Rather than flog LED lamps Philips leases them to some customers—including Britain’s National Union of Students—with a promise to keep buildings illuminated. By 2020 it wants to double to 15% the share of its profits from such contracts, which can lock in customers for 20 years. Safechem, a chemical company, rents out tanks of fresh solvent rather than selling it to manufacturers for cleaning metal parts. It then collects the tanks, purifies the contents and rents them out again.

Business models like these are grist to the mill of circular-economy advocates. They are presented as proof that lower resource intensity need not mean smaller profits. But their widespread adoption would not be painless for everyone.

This article appeared in the Special report section of the print edition under the headline “Modern-day alchemy” on The Economist.